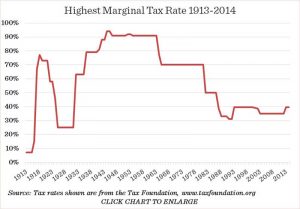

TL;DR: Debunking the Myth of the 90% Top Marginal Tax Rate Under Eisenhower The claim that the...

Taxes

Business Cycles: GDP and Revenues Correlating Tax Rates with Revenue Reagan TaxCuts: The Facts Bush Tax Cuts: The...

Claim: Jerry Brown called California tax payers freeloaders Fact: It’s not 100% clear who the “freeloader” comment was...

The facts regarding the percentage of Americans are as follows: Roughly half of all Americans pay no...

The ‘Fiscal Cliff’ deal included allowing the payroll tax holiday to expire. This tax holiday actually began...

I somehow found myself watching Fox News earlier (for the first time in awhile). Greta Van Susteren...