Black Friday has evolved from a single-day shopping event into a month-long marathon of deals, emails, and...

Economics

Marginal revenue product (MRP), sometimes referred to as the marginal value product, is a crucial concept in...

Claim: Social safety nets are intended to provide equality of outcome. What really matters is equality of...

Many have an exaggerated opinion of what markets can achieve. They mistakenly think of markets (and more...

It’s not uncommon to hear that “we are losing the America we used to be,” and that...

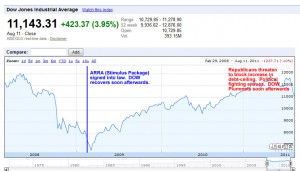

While outright rejecting the American Jobs Act, Republicans claim to have jobs bills of their own–bills which...

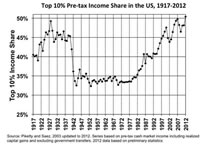

Robert Reich on the 7 biggest lies on taxes, the economy and more. Below is an expansion...

A few years ago, when I first learned that economic history shows that the economy has fared...

Recently Barack Obama announced plans for a second stimulus package. Known as the American Jobs Act. The American...