It’s not uncommon to hear that “we are losing the America we used to be,” and that we are evolving into this socialist nanny state where hard work and innovation are punished and failure is rewarded. That we are doing away with the ethic that made America the place of opportunity that it is/was/is ceasing to be.

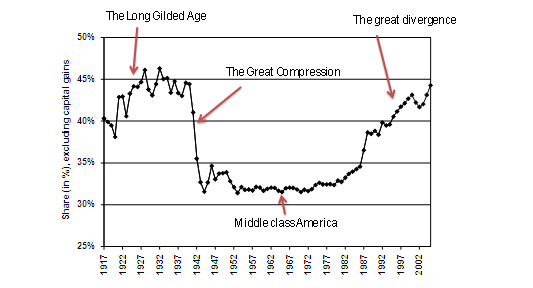

The problem with this as that it ignores some glaring historical contradictions. The golden age many of these people refer to came about after the creation of a strong social safety net (which has slowly eroded and has become underfunded), a string labor union movement, and a tax increase on the rich that would sound Marxist in today’s political newspeak. The late 1970’s and early 1980’s actually starts a trend away from this paradigm, and with it we see a period of union busting, lowered taxes on the top income earners, and slowly eroded social safety net. There also appears to be a change in the American ethos. What used to be understood as “there go I but by the grace of God” has become to seen as subsidies for “welfare queens” and the enabling of an “entitlement mentality.”

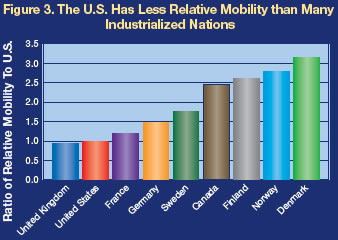

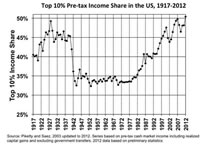

What does the data show? It shows that a viable middle class makes its debut after the implementation of said nanny state.

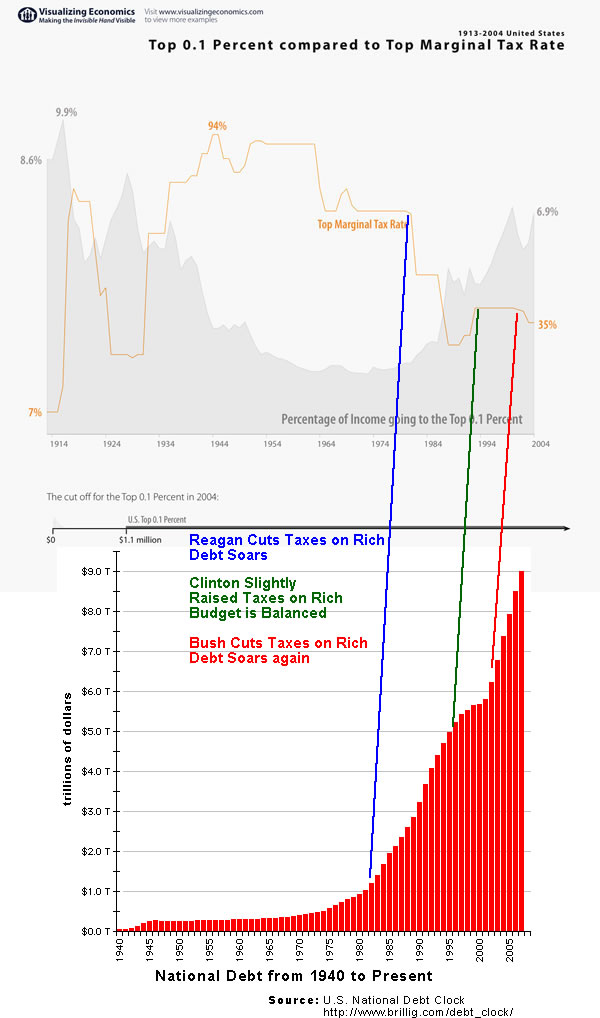

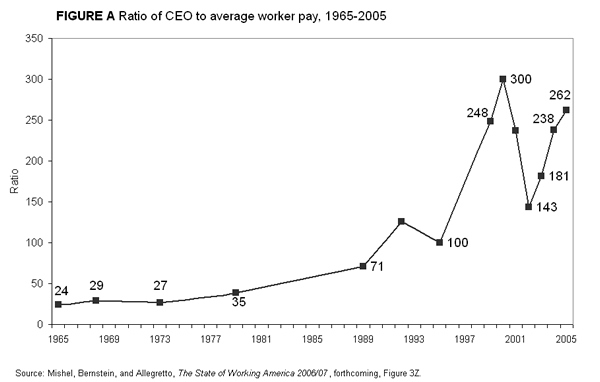

Conversly, the virtual disappearance of the middle class has coincided with a reversal of that trend. As taxes have been lowered on the rich, more government spending has been compensated for by printing/borrowing money, leaving us with the glaring debt problem we now face. Union busting (which gained traction under Reagan) has effectively neutered Unions, leaving them less able to leverage fair wages for employees. Not surprisingly, as the production of the American worker has increased, his/her wages haven’t kept pace. More and more of the increased wealth goes to the likes of CEOs and hedge fund managers.

This is what the decline of the top marginal tax rates and income for the top .1% looks like historically. Note the corresponding trend in the US National Debt.