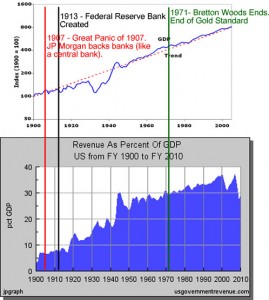

Part of Ron Paul’s narrative is that the federal reserve and the switch from a gold standard...

February 3, 2026

"Scam or Legit" Reviews & Complaints/Consumer Reports + Gossip & Current Events