Updates:

- U.S. Budget Deficit Narrows in First Nine Months of Fiscal Year

- Who Is The Smallest Government Spender Since Eisenhower? Would You Believe It’s Barack Obama?

- Obama spending binge never happened

- The trillion dollar deficit that Obama inherited has been cut in half

The US federal debt and budget deficit debate is one of the more politically contentious issues and has been for several years. Trying to make sense of it all can certainly be a daunting task for those new to the debate. But there are some fundamental points that help paint a clearer picture:

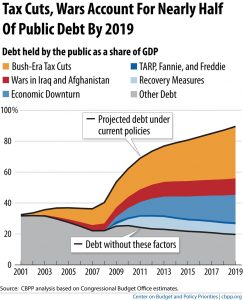

- The US Debt/Deficit has less to do with increased spending than with lowered revenues (30 years of tax cuts–largely on the wealthy, but exacerbated by the Bush Tax cuts) and the worst economic downturn since the Great Depression

- The most vocal Republican ‘deficit hawks’ are the very people who voted for these debt/deficit-increasing measures (along with voting for the wars, though they are less of a factor in the debt/deficit debate than is commonly assumed), and the biggest opponents against rolling them back

- The “increased spending” under Obama is the result of policies in place regardless of who the President is. Discretionary spending has actually risen the slowest under Obama, relative to previous US presidents.

- The Federal government has not grown under Obama. In fact, there are less federal workers under Obama than under many past administrations

- For an advanced western country, we actually have a relatively small government, especially in terms of social spending

- The bulk of our debt is owned domestically, not by foreigners