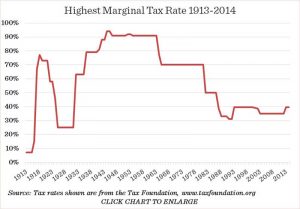

TL;DR: Debunking the Myth of the 90% Top Marginal Tax Rate Under Eisenhower The claim that the...

taxes

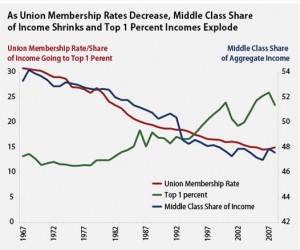

An article recently surface claiming that the rich pay “all of the taxes.” The reasoning behind the...