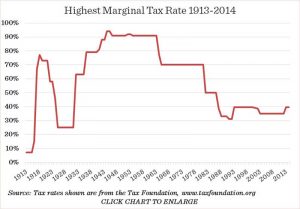

TL;DR: Debunking the Myth of the 90% Top Marginal Tax Rate Under Eisenhower The claim that the...

1 percent

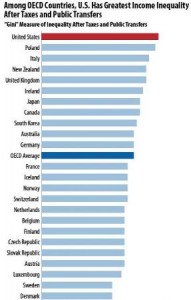

As noted countless times in this blog, the shift to a more supply-side (aka Reaganomics/trickle down economics)...